views

Introduction

Life insurance is one of the most important financial decisions you can make to protect your loved ones. But how much coverage do you actually need? Too little insurance can leave your family struggling, while too much may cost more than necessary. This guide will walk you through the key factors to consider and provide simple methods to calculate the right coverage amount for your needs.

Why Life Insurance Coverage Matters

Having the right amount of life insurance ensures that your family can: ✔ Cover daily living expenses and maintain their lifestyle.

✔ Pay off outstanding debts like a mortgage, car loans, or student loans.

✔ Fund future expenses such as college tuition and retirement savings.

✔ Cover funeral and medical costs.

Without adequate coverage, your loved ones may struggle financially after your passing.

How to Calculate Your Life Insurance Needs

There are several methods to determine the right coverage amount:

1. The 10x Income Rule (Quick Estimate)

- A simple rule of thumb: Multiply your annual income by 10.

- Example: If you earn $50,000 per year, you need at least $500,000 in coverage.

- Best for: Those who want a quick, basic estimate.

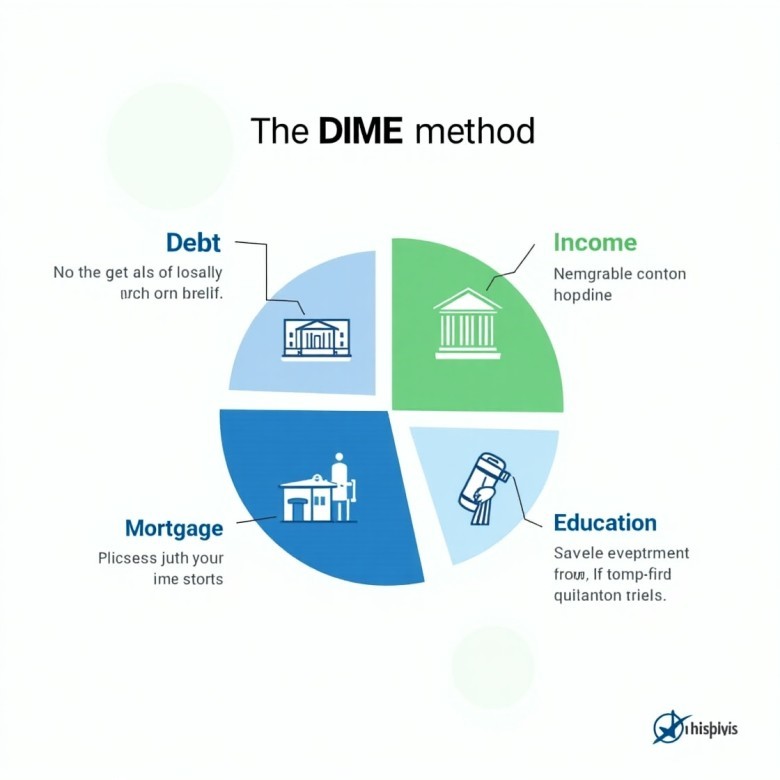

2. The DIME Method (Detailed Calculation)

DIME stands for Debt, Income, Mortgage, and Education, helping you break down your actual financial needs:

- Debt: Total outstanding loans (excluding mortgage)

- Income Replacement: Multiply your annual salary by the number of years your family would need support

- Mortgage: Balance left on your home loan

- Education: Estimated cost of children’s education

Example Calculation:

- Debt: $20,000

- Income Replacement: $50,000 x 10 years = $500,000

- Mortgage: $250,000

- Education: $100,000

- Total Coverage Needed: $870,000

3. Human Life Value Method (Long-Term Approach)

- Estimates your total lifetime earnings to ensure full income replacement.

- Formula: Annual Income × Working Years Remaining

- Example: If you're 30 years old earning $60,000 and plan to work for 35 more years, your coverage should be at least $2.1 million.

Factors That Influence How Much Coverage You Need

- Age & Health: Younger individuals typically need more coverage and get lower premiums.

- Family Size: More dependents require higher coverage.

- Debts & Expenses: Higher financial obligations increase your insurance needs.

- Existing Savings & Investments: If you have strong savings, you may need less coverage.

How to Choose the Right Life Insurance Policy

Once you know how much coverage you need, here’s how to select the right policy:

- Term Life Insurance: Best for affordability and fixed coverage periods (10, 20, or 30 years).

- Whole Life Insurance: Offers lifelong coverage with a cash value component but costs more.

- No-Medical Exam Policies: Ideal for quick approval but usually cost more.

Where to Get a Quote

- Compare policies from Haven Life, Policygenius, Ethos Life, and Banner Life for the best rates.

- Use online calculators to get an instant estimate.

Conclusion & Call to Action

Choosing the right amount of life insurance is crucial for financial protection. Use the 10x rule for a quick estimate or the DIME method for a detailed calculation. The key is to get insured early while rates are lower.

👉 Ready to secure your family’s future? Get a free life insurance quote today!

Have questions? Drop a comment below!

Comments

0 comment